- This event has passed.

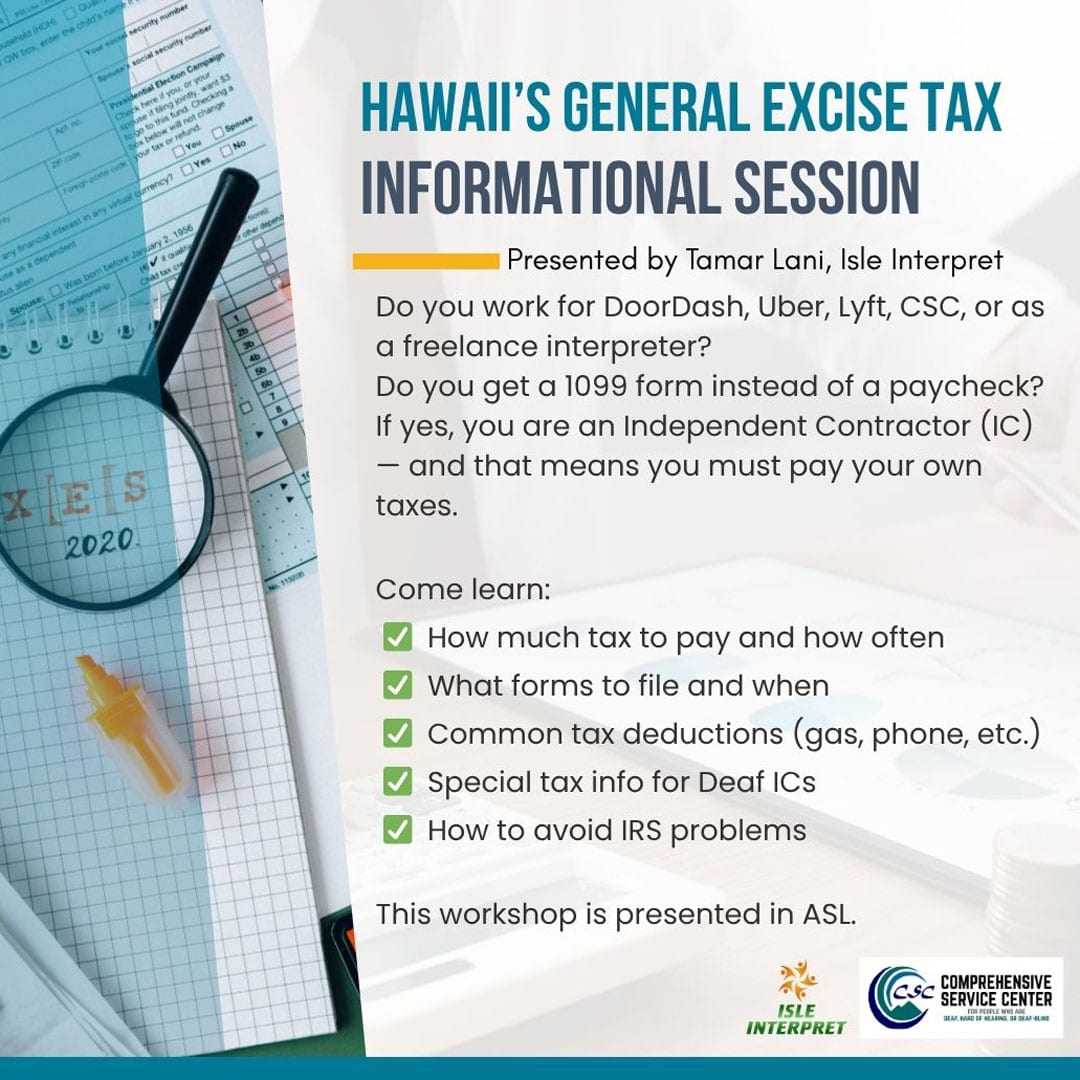

Hawaii’s General Excise Tax Information Session

August 5 @ 4:00 pm - 6:00 pm

Do you work for DoorDash, Uber, Lyft, CSC, or as a freelance interpreter? Do you get a 1099 form instead of a paycheck? If yes, you are an Independent Contractor (IC) — and that means you must pay your own taxes.

Come learn:

- How much tax to pay and how often

- What forms to file and when

- Common tax deductions (gas, phone, etc.)

- Special tax info for Deaf ICs

- How to avoid IRS problems

- This workshop is presented in ASL.